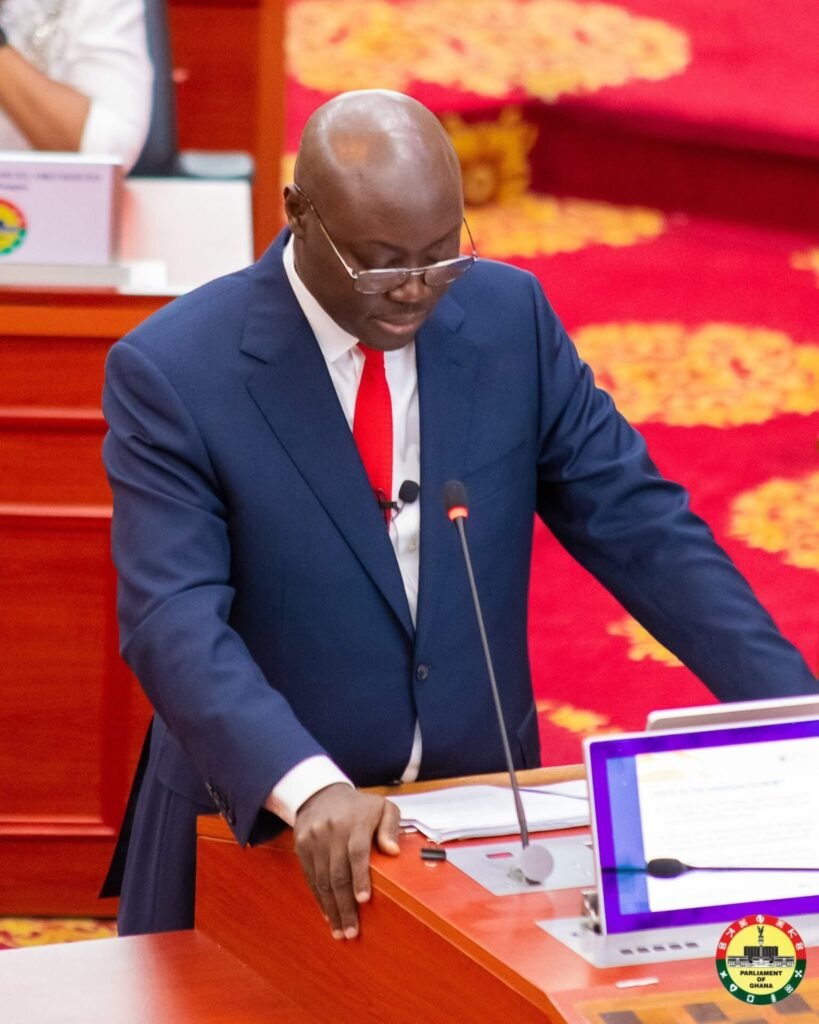

Finance Minister Dr. Cassiel Ato Forson has officially announced the abolition of the COVID-19 levy as part of the 2026 Budget, a move aimed at boosting household income, supporting businesses, and driving economic transformation.

Presenting the budget on Thursday, November 13, 2025, under the theme “Resetting for Growth, Jobs, and Economic Transformation,” Dr. Forson unveiled a series of value-added tax (VAT) reforms designed to ease the tax burden on Ghanaians and stimulate private sector growth.

“The new VAT reforms will abolish the COVID-19 levy, remove the decoupling of the GETFund and NHIS levy from the VAT tax base, and eliminate VAT on reconnaissance and prospecting of minerals,” he stated.

He further disclosed that the effective VAT rate would be reduced from 21.9% to 20%, while the VAT registration threshold will be raised from GH₵200,000 to GH₵750,000. Additionally, the zero-rating of VAT on locally manufactured textiles has been extended to 2028.

According to Dr. Forson, abolishing the COVID-19 levy alone will return approximately GH₵3.7 billion to individuals and businesses. The broader VAT reforms are expected to benefit households and enterprises by nearly GH₵6 billion.

He expressed confidence that these measures would stimulate economic activity, promote private sector expansion, and provide relief to citizens grappling with the high cost of living.

“By abolishing the COVID-19 levy, the government is putting money back into the pockets of individuals and businesses,” he said, emphasizing that the reforms reflect a commitment to fairness, efficiency, and inclusive economic recovery.