As at February 5, 2026, Ghana’s headline inflation rate stands at 3.8%, marking a consistent 13-month decline from a high of 23.8% recorded in December 2024.

The current figure represents the lowest inflation rate Ghana has recorded in nearly 27 years. The last comparable period was in 1999, when inflation stood at 1.4% in August and 4.4% in September. It is also the lowest level since the Ghana Statistical Service rebased the Consumer Price Index (CPI) in 2021.

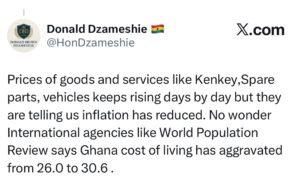

Despite the sharp decline in headline inflation, some Ghanaians say they are yet to feel any actual relief in their daily lives.

Complaints persist about the prices of goods and services either remaining high or continuing to increase, deepening concerns about the true cost of living.

This apparent disconnect between falling inflation figures and lived economic reality can be explained by several structural and economic factors that limit how lower inflation translates into household relief.

A major source of confusion lies in the difference between inflation and prices. Falling inflation does not mean prices are falling; it only means they are rising at a slower rate. Inflation measures the pace at which prices increase, not whether they decline.

A drop from extremely high inflation to single digits indicates that prices are no longer rising as rapidly, but it does not mean they are returning to pre-crisis levels. For example, if a bag of rice increased from GH₵300 to GH₵500 during periods of high inflation, lower inflation simply means the price may remain at GH₵500 or rise very slowly to GH₵510, rather than falling back to GH₵300.

Another key factor is stagnant income growth. Real wages for many workers including teachers, farmers, and lower-income earners have not increased enough to offset the cumulative price hikes of recent years. Even with inflation slowing, purchasing power remains weakened because incomes have failed to catch up with the lasting impact of past inflation.

Currency dynamics and market behavior also play a role. While official figures may point to a stronger cedi, many traders struggle to access foreign exchange at official bank rates. As a result, they rely on the parallel market, where rates are often higher, and pass these additional costs on to consumers.

In addition, prices tend to be “sticky” downward. Once traders raise prices, they are often reluctant to reduce them, citing high interest rates alongside broader costs of doing business. These factors limit price reversals even when inflation slows significantly.

Together, these dynamics help explain why Ghana’s lowest inflation rate in decades has yet to translate into noticeable relief for many households.